Finance Committee proposes real estate tax rebate, budget cuts; Planning Commission to consider proposed ordinance requiring CUP for businesses selling controlled substances

Engage Louisa is a nonpartisan newsletter that keeps folks informed about Louisa County government. We believe our community is stronger and our government serves us better when we increase transparency, accessibility, and engagement.

This week in county government: public meetings, April 7 through April 12

For the latest information on county meetings including public meetings of boards, commissions, authorities, work groups, and internal county committees, click here. (Note: Louisa County occasionally schedules internal committee/work group meetings after publication time. Check the county’s website for the most updated information).

Monday, April 7

Finance Committee, Louisa County Office Building, 1 Woolfolk Ave., Louisa, 2:30 pm.

Louisa County Board of Supervisors, work session, Public Meeting Room, Louisa County Office Building, 1 Woolfolk Ave., Louisa, 4 pm. (agenda, livestream)

Supervisors will hold a work session with the Virginia Department of Transportation to discuss the Secondary Six-Year Road Plan.

Louisa County Board of Supervisors, Public Meeting Room, Louisa County Office Building, 1 Woolfolk Ave., Louisa, 6 pm. (agenda packet, livestream)

Tuesday, April 8

Louisa County Electoral Board, Office of Elections, 103 McDonald St., Louisa, 10 am.

Ag/Forestal and Rural Preservation Committee, Public Meeting Room, Louisa County Office Building, 1 Woolfolk Ave., Louisa, 7:30 pm.

Wednesday, April 9

James River Water Authority, Fluvanna County Administration Building, 132 Main St., Palmyra, 9 am.

Louisa County Water Authority, 23 Loudin Lane, Louisa, 6 pm.

Thursday, April 10

Louisa County Planning Commission, long-range planning work session, Public Meeting Room, Louisa County Office Building, 1 Woolfolk Ave., Louisa, 5 pm. (agenda packet, livestream)

Louisa County Planning Commission, Public Meeting Room, Louisa County Office Building, 1 Woolfolk Ave., Louisa, 7 pm. (agenda packet, livestream)

Quote of the week

“Witnessing firsthand how [staffers] navigate the current space shortage while providing unwavering care and love was truly inspiring. This experience reinforces why the proposed shelter expansion in our county's [Capital Improvement Plan] is so vital. Even with limited space, their dedication shines through.”

-Green Springs District Supervisor Rachel Jones in a March 14 Facebook post, expressing support for a proposed expansion at the Louisa County Animal Shelter after touring the facility.

The shelter has twice reached what staffers termed “critically full” in the last few months. Now, two members of the board of supervisors have proposed pushing back its expansion to free up money for a real estate tax rebate in the Fiscal Year 2026 budget. Read more in the article below.

Finance Committee proposes real estate tax rebate, budget cuts

Amid pushback from residents concerned about their rising real estate tax bills, two members of the Louisa County Board of Supervisors have proposed slashing $2.2 million from the county budget for the coming fiscal year and putting that money back in taxpayers’ pockets.

Mineral District Supervisor Duane Adams and Jackson District Supervisor Toni Williams, a pair of Republicans who serve on the board’s Finance Committee, have recommended retaining a level real estate tax rate of 72 cents per $100 of assessed value for Fiscal Year 2026 but giving property owners a one-time tax rebate equal to a two-cent reduction in the rate.

The move is aimed at easing the pain of homeowners’ escalating tax bills as the assessed value of real estate in the county jumped an average of 8.12 percent this year.

To make up for the revenue lost from the rebate, the Finance Committee recommends pushing back to FY27 a 3,000-square foot expansion at the Louisa County Animal Shelter, expected to cost $1.95 million; axing three new staff positions for the Fire and EMS Department, good for more than $200,000 in savings; and making other minor adjustments to the budget.

“This recommended budget addresses the primary input the board heard from our citizens by proposing tax relief in the form of a .02 cent rebate on the real estate tax rate for FY26,” Adams said in an email to Engage Louisa on Thursday. “This recommendation funds the essential services of our county while maintaining a balanced budget and being fiscally responsible to our taxpayers.”

The committee is expected to formally recommend the rebate and corresponding cuts at Monday night’s meeting where supervisors will hold a public hearing on the proposed spending plan and the local tax rates that generate more than half the revenue to fund it. Budget adoption is slated for the board’s April 28 meeting and the new fiscal year kicks off July 1.

The board has advertised a $190.5 million budget for FY26, including $175 million for daily operations, covering everything from employees’ salaries to fuel for fire trucks, and $15.5 million for capital projects, allotted for big-ticket items like major renovations and new emergency services equipment.

But if supervisors move forward with Adams’ and Williams’ plan, the budget will shrink to $188.3 million with operating expenses trimmed by more than $200,000 and capital costs cut by almost $2 million.

The board has also proposed a slate of level tax rates, including the 72-cent rate for real estate and a $2.43 rate for cars and trucks. Neither rate has changed since 2015, and both rank among the lowest in the region.

Under the Finance Committee’s plan, the board will maintain a flat rate for real estate. But with the rebate, property owners will pay taxes based on a 70-cent levy. A resident whose house is assessed at $400,000 would pay about $80 less based on the plan.

But, even with that relief, many homeowners will see their tax bills rise thanks to the uptick in assessments. Supervisors would have to lower the rate to 66.6 cents or extend a roughly 5.4-cent rebate to offset the roughly eight percent increase.

The Finance Committee’s proposal comes after a March public hearing where more than a dozen community members weighed in, urging the board to lower the tax rate to offset the jump in assessments. Some speakers said that if the board votes for a level rate, they’re supporting a tax increase. They insisted that escalating assessments have caused their tax bills to balloon over the last few years.

Beyond the roughly eight percent jump this year, the assessed value of real estate, which is largely based on property’s market value, climbed nearly eight percent last year. It jumped, on average, 13.9 percent in 2023 and about 12 percent in 2022.

Several homeowners told the board that their rising tax bills are unsustainable, and they wonder how much longer they can afford to live in the county.

Lake Anna resident Bruce Tenney said that he and his wife retired here about five years ago after doing a cost-of-living analysis. Since purchasing their home, Tenney said its assessed value has soared some 80 percent, leading to a dramatic increase in their taxes.

“My wife and I built what we hoped was a forever home. But, at this kind of tax increase, it’s going to be really hard to stay here,” he said.

Ed Heany, a life-long Louisa resident, agreed. Before buying his home several years ago, Heany said he carefully budgeted for his monthly mortgage payments. Since then, his property’s assessed value has jumped more than $140,000, he said, and the corresponding tax hike has blown a hole in his budget.

“You’re trying to push out the lower class and the working man,” Heany said.

The board has heard similar pleas over the last few years but declined to lower the rate. Board members have contended that the county needs the additional revenue generated by increased assessments to cover the burgeoning cost of county services, which they attribute to inflation and rapid residential growth. They’ve also said they don’t want to turn adjustments to the tax rate into an annual political fight, preferring to keep it stable.

Supervisors have found other ways to deliver modest and targeted relief, including providing a one-time, five percent rebate on real estate taxes in 2023. They’ve also broadened eligibility requirements for a tax relief program for low-income elderly and disabled residents.

While those measures satisfied some, others continue to criticize the board, arguing that the county’s spending is out of control, and supervisors need to tighten their belts and slash the tax rate.

Board members had offered few clues about how they’d respond to community concerns this year. Aside from Adams assuring attendees at last month’s public hearing that the budget process is transparent, no board member commented on what they heard during the hearing nor did they explicitly discuss the tax rate or a potential rebate at three budget work sessions. Those sessions were mostly spent discussing how much funding the county should provide to a handful of nonprofits, who receive a tiny fraction of the county budget.

Cuckoo District Supervisor Chris McCotter announced the proposed changes in a Facebook post Thursday morning and shared a link to the 154-page proposed budget posted on the county’s website.

While the document reflects the two-cent tax rebate and other components of the Finance Committee’s plan, it doesn’t explicitly state that three new Fire and EMS positions would be removed or that the committee recommends pushing back the animal shelter expansion. That information isn’t included in the agenda packet for Monday’s meeting either where the board will hear feedback from the public on the budget.

A ‘critically full’ shelter

The Louisa County Animal Shelter and its staff would see the most significant impact from the budget cuts if the board opts for the Finance Committee’s plan.

County officials have expressed concern about space limitations at the facility, which has twice reached what staff termed “critically full” in the last three months.

In a Facebook post in late January, staff said the shelter was “out of space for a certain type and size of animal,” and it was unable to take in new animals “without compromising the support of existing shelter animals.” The county issued a press release in late February again saying the shelter was at capacity.

General Services Director Anderson Woolfolk requested funding to expand the facility last year. In a presentation to the planning commission is January, Woolfolk said that the county established the current shelter in the 1980s by repurposing an old slaughterhouse. He said, at the time, the county took in between 700 and 800 animals per year, but that figure has since doubled.

Woolfolk said in a written request that the expansion would provide much needed space for animal care, animal holding and quarantining inside the building. It would also provide room for offices and storage. Outside, the expansion would include an enlarged fenced-in animal play area, he said.

Since 2016 the shelter has operated as “no kill,” Woolfolk said, meaning it euthanizes less than 10 percent of the animals it takes in. The expansion is necessary to help ensure it retains that status, he said.

“If this project is not funded the county runs the risk, due to the limited animal holding space and the steady increase of the population in and around the county, of having to euthanize healthy animals due to a lack of holding space,” Woolfolk said in his written request.

Woolfolk also noted that the expansion would provide the flexibility necessary to move forward with renovations in the existing facility, including revamping the animal intake area to help prevent the spread of disease and providing more office space for shelter staff.

Woolfolk estimated that the expansion would take at least a year to complete. If the board opts to push back the funding to FY27, the expansion likely wouldn’t be finished until the second half of calendar year 2027 or early 2028. The delay would presumably push back the timeline for additional improvements.

It’s unclear if the five other supervisors are on board with the Finance Committee’s proposal. At least one board member has publicly commented on the urgency of the shelter expansion.

In a March 14 Facebook post, Green Springs District Supervisor Rachel Jones said she’d recently toured the facility and saw the problems presented by the lack of space.

“Witnessing firsthand how [staffers] navigate the current space shortage while providing unwavering care and love was truly inspiring. This experience reinforces why the proposed shelter expansion in our county's [Capital Improvement Plan] is so vital. Even with limited space, their dedication shines through,” Jones said.

But Jones has also pushed to cut the real estate tax rate or find another way to deliver tax relief in next year’s budget. She declined to comment on the Adams’ and Williams’ proposal.

A closer look at the proposed budget

If the board moves forward with the Finance Committee’s plan, the budget will top $188.3 million for FY26 with $174.8 million allotted for daily operations and $13.5 million for capital projects.

While the total budget would come in about 10 percent less than this year’s spending plan—thanks to a significant reduction in capital spending—the operating component would jump more than $18 million, a roughly 12 percent increase over FY25.

Driving that jump are 10 new full-time staff positions, including three for the General Services Department; a three percent pay hike for county employees; a 7.5 percent hike in health insurance costs; and a $5.5 million increase in debt service payments. The latter payments jumped significantly after the county borrowed nearly $80 million, mostly for school construction and water and sewer infrastructure.

A roughly 6.9 percent increase in funding for Louisa County Public Schools is also pushing the budget upwards. The schools’ budget, expected to top $97 million with about half that money coming from local funds, includes 10 new teaching positions, six of which were added during the current fiscal year; a three percent pay hike for faculty; and a four percent raise for custodians, bus drivers and cafeteria workers, among other compensation increases.

Of the $174.8 million allotted for daily operations, about 55 percent goes to the schools while nearly 15 percent pays for public safety, including the Louisa County Sheriff’s Office and the Fire and EMS Department. Spending on public safety is expected to rise about nine percent in FY26.

Next year’s proposed capital budget is significantly slimmer than the last two years when the board funded more than $62 million in school construction.

Based on Adams’ and Williams’ proposal, the capital budget would top $13.5 million with nearly $5 million of that allotted for the Fire and EMS Department, mostly for new emergency services equipment. About $3.5 million is earmarked for the General Services Department, primarily for renovations and repairs at the county’s circa 1905 courthouse, the County Office Building and the Louisa Medical Center.

To fund its daily operations, the county expects to pull in about $185 million in revenue, leaving a roughly $10 million operating surplus. The Finance Committee proposes using that money to help cover capital spending. The committee recommends tapping $3.33 million from the county’s long-term capital reserves to cover the rest of those costs.

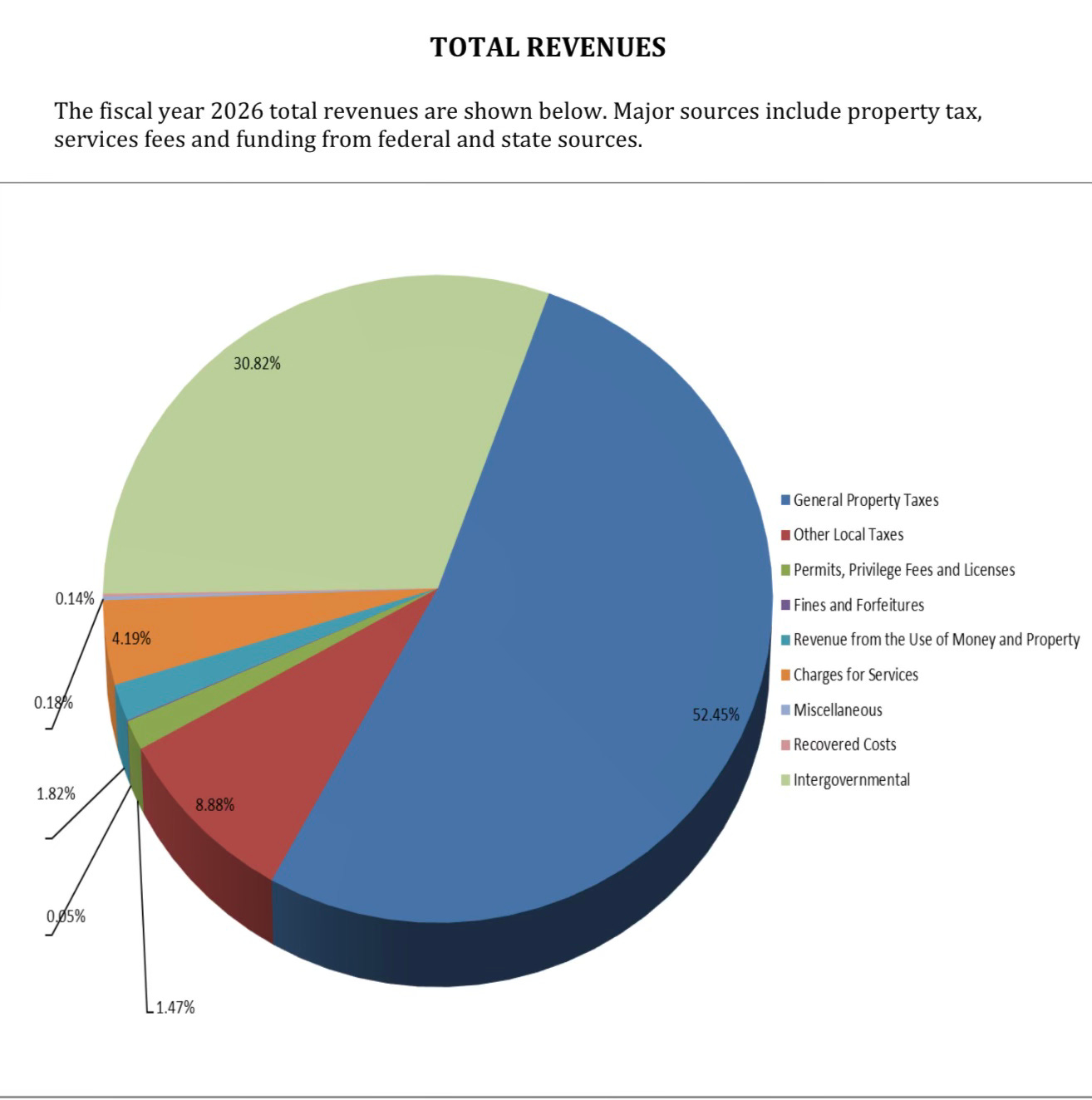

The county pulls its operating revenue from a variety of sources with more than 52 percent generated by general property taxes, 30 percent derived from state and federal sources and 8.8 percent pulled from other local taxes.

Even with the rebate, revenue from general property taxes is expected to increase more than six percent over FY25, and money from other local taxes is expected to rise about 9.7 percent, driven mostly by increases in sales and business license tax revenue.

While the budget proposal shared on the county website represents the Finance Committee’s final recommendation, county officials acknowledge that it could require some adjustments, given potential changes in state and federal funding.

Officials are waiting for the Democratic-controlled General Assembly and Republican Governor Glenn Youngkin to agree on amendments to the biennial state budget, which could impact local revenues.

They’ve also said they’re cognizant of potential cuts to federal funding as President Donald Trump’s Department of Government Efficiency (DOGE) looks to downsize the federal government and slash spending.

In his email, Adams said the Finance Committee considered “uncertainty” in federal funding when crafting the budget, but he declined to elaborate on whether he had any specific concerns about potential cuts.

“We are taking a wait and see approach,” he said.

County Administrator Christian Goodwin was also circumspect when asked if the county had received any communication from federal agencies about possible cuts.

“The county continually receives information from the federal (and state) government on grants, grant reviews, and grant terms/conditions. At this time, we’re not aware of any confirmed reductions in direct federal funding,” Goodwin said in an email on Friday.

According to Finance Director Wanda Colvin, the county directly received more than $15.4 million in federal funding this fiscal year with nearly $12.5 million derived from one-time grant money. The county received $2.6 million to support programs administered by the Human Services Department.

Louisa County Public Schools received an additional $5.4 million in federal support with nearly $3 million tied to its breakfast and lunch program. The division participates in the USDA’s Community Eligibility Provision program, which enables all six of its schools to provide free meals to any student. That program could see significant cuts if Congress and the president move forward with a proposal passed by the House of Representatives in February.

Check out the proposed budget for FY26.

Other business

Supervisors to consider moving polling places for Green Springs 2, Louisa 3 precincts to Trevilians Elementary School

At the request of General Registrar Cris Watkins, supervisors will hold a public hearing and consider moving the polling locations for the Green Springs 2 and Louisa 3 precincts to Trevilians Elementary School, 2035 S. Spotswood Trail (Route 33). Both polling places are currently located at Living Grace Church on James Madison Highway (Route 15) outside the Town of Gordonsville.

In an email to Engage Louisa, Watkins said the Louisa County Electoral Board recommended the move because of a lack of space at the church and traffic safety concerns.

“With there being two precincts [at the church], we’ve just outgrown the space…[Also], it’s dangerous pulling out of there with traffic moving so fast on 15,” Watkins said.

If supervisors approve the request, voters will cast their ballots at the elementary school for the first time in the November 4 General Election. They’ll continue to vote at the church through the June 17 primary.

Trevilians Elementary is already home to the polling place for the Louisa 2 precinct. Watkins said that if three polling places occupy the school, each will be staffed by its own election officers. They’ll also have separate check-ins and voting machines.

Supervisors to consider approving budget supplement for LCWA

Supervisors will consider approving a $110,000 budget supplement for the Louisa County Water Authority (LCWA) to cover its share of an upgrade at the Louisa Regional Wastewater Treatment Plant.

According to the proposed resolution, the money will help pay for replacing the plant’s headworks screen. The project is expected to cost $220,000 with the Town of Louisa on the hook for half the money.

The resolution says the repair is necessary for the system to continue operating properly.

Assuming the board okays the expenditure, the county will draw the money from its general fund.

Supervisors to consider moving multiple LCPS capital projects from FY26 to FY25

Supervisors will consider greenlighting the start of a handful of capital projects proposed by Louisa County Public Schools. The projects are included in the capital budget for Fiscal Year 2026. But, pending board action, they’ll be permitted to start in FY25.

The projects total $788,000, including $570,000 for paving and parking lot repairs; $100,000 for cafeteria equipment; $75,000 for classroom furniture; $25,000 for carpet and flooring; and $18,000 for an atrium at Thomas Jefferson Elementary School.

School officials say they want the money now—as opposed to after July 1, the start of the new fiscal year—so they can complete the projects prior to the 2025-26 academic year.

Regardless of when it’s appropriated, funding for the projects will be drawn from the division’s long-term capital reserves.

In a separate action that could impact the budget, the board will consider authorizing the Virginia Public Schools Authority to refund school bonds issued more than 15 years ago. The refund could potentially save the county $97,600.

Board to consider okaying start of park maintenance capital project at Betty Queen Center

Supervisors will consider approving the start of a roughly $33,000 capital project to repair recreational facilities adjacent to the Betty Queen Center. The board allotted funding for the project in a previous budget.

The project will cover improvements at the Betty Queen Center playground and walking track, including stabilizing the playground, installing a guardrail, repairing a retaining wall and adding a drainage system.

VDOT to present quarterly report; Supes to hold work session on Secondary Six-Year Road Plan

Virginia Department of Transportation (VDOT) Residency Administrator Scott Thornton will present his quarterly report, updating the board on VDOT’s work in the county, from road maintenance to speed studies.

Prior to their regular meeting, supervisors will convene a 4 pm work session with Thornton to discuss the county’s Secondary Six-Year Road Plan. The plan covers road improvements in the secondary system from FY26 through FY31, drawing funding from the state’s Rustic Road program, which is specifically aimed at paving unpaved public roads, and “telefee” funds, money paid by telecommunications companies that use public right of ways.

The plan is subject to board approval annually.

PC to consider proposed ordinance requiring CUP for businesses selling controlled substances

The Louisa County Planning Commission on Thursday night will hold a public hearing and consider whether to recommend to the board of supervisors approval of a proposed ordinance restricting where businesses selling cannabis can set up shop in the county, though state lawmakers have yet to legalize a retail market for the substance.

Under the proposal, establishments engaged in the retail sales of controlled substances would be required to obtain a conditional use permit (CUP) from Louisa County. With the permit, the use would be permitted in General Commercial and Light Commercial zoning inside and outside of Growth Area Overlay Districts (C-1, C-2, C-1 GAOD, C-2 GAOD), Planned Unit Developments (PUD) and Resort Developments (RD). It would be prohibited in all other zoning districts.

Obtaining a CUP requires a lengthy public approval process including public hearings in front of the planning commission and the board of supervisors and an affirmative vote by the latter body.

The proposed ordinance would apply to any establishment selling prescription medications, hemp products intended for consumption, substances containing any percentage of controlled substances, and other regulated substances, according to a proposed definition for the use. The category includes pharmacies, dispensaries, and other authorized retail establishments, but excludes alcohol and tobacco sales, and passive agricultural activity.

Controlled substances are defined and regulated by the federal government based on their medical use, potential for abuse, and safety or dependence liability.

Existing businesses that sell controlled substances would be grandfathered in and not subject to the new rules.

Deputy County Administrator Chris Coon told the commission during a February work session that members of the board of supervisors asked staff to draft an ordinance governing the sale of controlled substances amid concerns that the General Assembly would pass legislation establishing a retail market for recreational cannabis, and as shops crop up in the county selling cannabis-adjacent products.

The county currently doesn’t have an ordinance regulating where businesses that sell controlled substances can peddle their wares, Coon said, and staff and board members hope to get something in place ahead of potential action from Richmond.

The Democratic-controlled General Assembly passed legislation during the last two legislative sessions establishing a retail cannabis market, but Governor Glenn Youngkin twice vetoed the bill. Under existing law, adults are permitted to possess a small amount of cannabis and grow up to four plants for personal use. But retail sales aren’t permitted outside of licensed medical dispensaries.

In a memo to the commission, Coon said the proposed ordinance would allow for both transparency and community involvement in regulating the retail sales of controlled substances and provide “flexibility to respond to evolving community standards while providing a consistent regulatory pathway.”

“This approach allows the county to evaluate each proposed establishment on a case-by-case basis through the CUP process, ensuring appropriate community compatibility and compliance with applicable standards,” Coon said.

Coon noted that the CUP process would allow the county to impose conditions on businesses selling controlled substances to mitigate their impact, including regulating their hours of operations, signage, security measures and proximity to sensitive uses like schools and child care centers.

Other business

Beyond the lone public hearing, commissioners will hold a pre-meeting work session where they’ll continue to discuss focus areas plans for the county’s eight designated growth areas. They’ll also discuss proposed tweaks to the county’s Land Development Regulations that touch on everything from how the county defines certain uses to plat approvals and setback requirements.

Click here for contact information for the Louisa County Board of Supervisors.

Find agendas and minutes from previous Board of Supervisors and Planning Commission meetings as well as archived recordings here.

Click here for contact information for the Louisa County School Board.

Click here for minutes and agendas for School Board meetings. Click here for archived video.

Click here to access past editions of Engage Louisa.

Emailing my rep today to let him know that the tax rebate is a slap in the face to residents. 80 dollars is not enough to justify cutting the County programs that are being considered.